Across the political sphere, I hear a common refrain: ‘I like Bernie Sanders because he’s sincere and honest.’ And, yes, it is true that Bernie’s stuck to the same message throughout his political life. He is indeed a true believer. That his true belief is an ideology that has inflicted catastrophic and systemic poverty, and killed a hundred million people (more, but you get the idea) is of secondary importance, apparently, as is his affinity for socialist dictators. In pondering his campaign message, however, I question that assessment, especially when it comes to taxes.

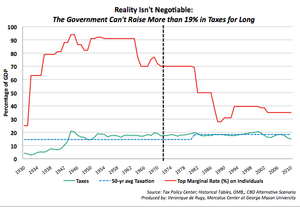

Bernie has been peddling the notion that he can spent additional trillions of dollars without beating the hell out of the middle and working classes via taxation. His history of sincerity and consistency is, apparently, sufficient proof for many of his acolytes. Most of them are, I suspect, ignorant of an historical observation dubbed Hauser’s Law, which notes that, no matter income tax rates or the structure of the tax code, tax revenues stay at a long-term steady-state average of 19.5% of GDP. A bit more during boom economies, a bit less during recessions, but always normalizing around that average.

There’s a message in Hauser’s law. It’s an obvious one, a message as obvious as Herbert Stein’s Law, which tells us that, “If something cannot go on forever, it will stop.” That message is that people change their behaviors in response to changing conditions, in this case the income tax code. We are willing to cough up 19% of our income, in the aggregate, to fund the government, and if the government tries to take more, we find ways to keep that from happening.

Many who believe in raising taxes like to point out that the tax code had a top rate of 91% back in the 1950s, a datum that’s supposed to, I imagine, allay our fears over the harm that higher tax rates might cause. The typical rebuttal is that almost no one actually paid that rate, for various reasons, but I’ve found that to be less compelling than simply pointing out that tax revenues as a percent of GDP were the same then as they are now, that 91% top rate notwithstanding, so there’s no utility in restoring such a massive rate.

Many who believe in raising taxes like to point out that the tax code had a top rate of 91% back in the 1950s, a datum that’s supposed to, I imagine, allay our fears over the harm that higher tax rates might cause. The typical rebuttal is that almost no one actually paid that rate, for various reasons, but I’ve found that to be less compelling than simply pointing out that tax revenues as a percent of GDP were the same then as they are now, that 91% top rate notwithstanding, so there’s no utility in restoring such a massive rate.

Still, the greedy and envious (because, lets face it, that’s what the “tax the other guy to give me more free shit” people are), think that Bernie and some other Best-and-Brightest can find ways to squeeze more blood out of the American taxpayers’ carcasses. Indeed, it seems that many are more interested in knocking down the other guy than they are in seeing more prosperity for everyone.

There’s the tragedy. The second message in Hauser’s Law is this: If the government wants to maximize revenue, it should set rates and tax policy so that economic growth is most encouraged. Grow GDP, end up with more dollars. We see that happening right now: Revenues are up despite, or because of, or apart from, Trump’s tax cuts.

Bernie figures to pay for everything by raising taxes on the rich and on Wall Street. This is all cool with the BernieBros, because it’s other people who’ll pay. In this they ignore that wreaking havoc on Wall Street will screw their 401Ks, their pensions, and the public employee pension funds of many states that are already in the red. They also stand in ignorance of Hauser’s Law, which tells us that Bernie won’t get the extra money to pay for his schemes by raising rates.

We find the truth in Bernie’s (purported – hold that thought) admiration of Europe’s policies. European welfare states ‘pay’ for all their giveaways, and get around facing their own versions of Hauser’s Law, by imposing a consumption tax/VAT as well as an income tax. THAT is what Sanders will have to do to fulfill his vision, and THAT is certainly not a tax on ‘other people.’ In fact, VATs are a regressive form of taxation, impacting those in the lower economic strata the most, and in fact, the average European is poorer than the average American.

Fans of Bernie, wake up to this reality: If he becomes President, he’s going to try and tax the everliving snot out of you, and your neighbors, and your friends, in order to further his pig-headed pursuit of an ideology that has never worked and never will work. Oh, and before you point at the Nordic model, here’s a news flash. Bernie is promising the Nordic model results, but wants nothing to do with its actual policies. His is the Venezuelan way, and we all know how that turned out.

A post-script for everyone else: If we are ever to balance the budget and eventually get out from under our national debt, Hauser’s Law tells us that spending must be cut. Fiscal conservatives lamented Trump’s tax cuts as reckless with regard to the deficit and debt, but that view ignored reality as much as Sanders’ “we can tax the rich to pay for everything” fantasy. Deficits are a spending problem, full stop. The path out of this hole is also found in history, specifically in the history of our friends to the North. Canada fixed her fisc by freezing spending and letting revenues grow as GDP grew, then restricting government spending growth to a percentage lower than GDP growth. It can be done, because it has been done. We can grow our way out of our debt, but it’s going to take a will and a discipline that neither major party has shown any interest in embracing. That won’t change until we demand it does.

Mr. Hauzer, at the federal level there are No ‘tax revenues’. The federal government creates all the money it needs. In fact, the federal government has a monopoly on creating dollars. No other entity can create dollars. It has no need for our tax dollars in order to spend as much as it wants. Please learn about Modern Monetary Theory. Most people get it. You should too.

Oh, yes, I know all about Modern Monetary Theory.

It’s the latest form of snake oil being sold to people who want to believe that there is, indeed, such a thing as a free lunch. And, yes, I’ve blogged about it.

http://www.pigsandsheep.org/selling-a-free-lunch/ http://www.pigsandsheep.org/rights-and-wrongs/

Tell me, though, if MMT does indeed say that the feds can create all the money they need, why tax *anyone*? Why pitch redistribution, massive taxation of the rich, banging Wall Street, and confiscating the already-taxed wealth of some? Why not just print all the money they need to pay for all the stuff they want to give away?

MMT is garbage word salad, intended to convince fresh fools that the sky isn’t blue and water isn’t wet.

http://www.pigsandsheep.org/fresh-fools/