As the GOP/Trump tax reform plan approaches the finish line, the hyperventilation regarding one of its major provisions is cresting. Yes, this is about the much maligned (by Democrats, at least) limit on deductibility of state and local taxes (SALT).

Under current tax law, state and local income and property taxes can be deducted from taxable income by anyone who itemizes their tax returns. The new tax plan caps that deduction at $10,000. People and politicians from high-price cities and high-tax states are, naturally, aghast. They contend that this is the Republican Party sticking it to the blue states, that this deductibility is vital to many people who might be considered wealthy by rural standards, but who are merely middle-class, with little wiggle room in their finances, in places like New York City and its suburbs.

Indeed, even the conservative-leaning New York Post has sounded the alarm, wherein Jonathon Trugman presents an example of a NYC-area couple that earns a combined $190,000 and pays a total of $36,206 in state & local income taxes and property taxes. Under the new tax code, they’d lose $26,206 worth of Schedule A deductions. The article stops there, and doesn’t do the final calculation, so permit me. Under the current details of the new tax plan, the couple would be paying a top marginal tax rate of 22%, so they’d owe an additional $5765 in federal income tax because of the un-deductible portion of SALT.

Or, would they?

What the article fails to acknowledge is that other elements of the new tax proposal offset that tax liability. The standard deduction nearly doubles, from $12,700 to $24,000, and the per-child credit doubles, from $1000 to $2000. If the couple loses the ability to itemize, due to the SALT cap, the increase in standard deduction of $13,300 translates into $2926 worth of tax savings. That offsets a good chunk of that $5765 liability increase.

But wait, there’s more.

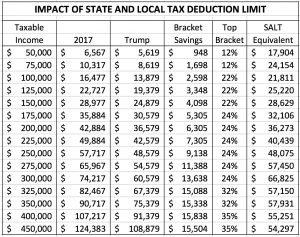

The new tax code changes the tax brackets and the rate each bracket pays. Consider our hypothetical couple, earning $190,000. Lets say that they take the standard deduction, and have some other deductions (perhaps an IRA) that brings their taxable income down to $150,000. The table* to the right shows that their tax liability due to the new brackets will decrease by $4098. Yes, they’d owe more tax, but $1667 is a far cry from $5765. And, if their taxes aren’t as high as the article claims (this couple is shown to pay both city taxes and suburban property taxes (NYC property taxes are much lower) – that doesn’t happen), then they may very well see a reduction in tax liability due to the bracket change, despite the SALT cap.

The new tax code changes the tax brackets and the rate each bracket pays. Consider our hypothetical couple, earning $190,000. Lets say that they take the standard deduction, and have some other deductions (perhaps an IRA) that brings their taxable income down to $150,000. The table* to the right shows that their tax liability due to the new brackets will decrease by $4098. Yes, they’d owe more tax, but $1667 is a far cry from $5765. And, if their taxes aren’t as high as the article claims (this couple is shown to pay both city taxes and suburban property taxes (NYC property taxes are much lower) – that doesn’t happen), then they may very well see a reduction in tax liability due to the bracket change, despite the SALT cap.

Yes, the SALT cap is, pun obviously intended, salt in the wound of people living in states that choose to heavily tax their citizens, but the reality is that this deduction has provided cover for decades to the politicians of those states – AND – burdened the citizens of low-tax states. And, yes, the hysteria over its impact is tendentious. By failing to acknowledge the benefit of the bracket change, the decriers are spreading falsehoods.

While it is indeed fair to say that a couple with two kids earning $190K in the New York metro area qualifies as middle-class, it is also fair to say that the Left’s desire to tax “the rich” more and more and more would tag this couple as “the rich,” given that their income puts them well into the “top 5%” bracket. So, to hear crying about the SALT deduction cap (which will only affect high earners in high tax states), seems a bit like crocodile tears.

Perhaps, just perhaps, this SALT cap will wake people in high-SALT areas up to the tax-and-spend profligacy of the people they elect.

- Some notes on the attached table, which reflects tax brackets for married-filing-jointly. It does not reflect the increased standard or per-child deductions in the bracket savings figure, so those who already don’t itemize will actually see a greater liability reduction (because their taxable income will decrease). The SALT-equivalent figure represents the total SALT value that the bracket decrease offsets. Thus, a couple earning $200,000 that pays $36,273 in SALT would see no adverse impact from the deductibility cap.

NOTE: I am not a financial adviser. This article is not intended to present any advice, tax or otherwise, nor do I warrant that the figures are correct. Do your own math, talk to your financial and tax professionals.

Active Comment Threads

Most Commented Posts

Universal Background Checks – A Back Door to Universal Registration

COVID Mask Follies

When Everything Is Illegal…

An Anti-Vax Inflection Point?

“Not In My Name”

The Great Social Media Crackup

War Comes Through The Overton Window

The First Rule of Italian Driving

Most Active Commenters